In a few extreme cases you might not have to provide your parents income on the FAFSA even if you are considered dependent based on the above conditions. Your Expected Family Contribution is based on your familys total income including both taxed and untaxed income assets and dependency status dependent student or independent student.

Unless the parents earn more than 350000 a year have only one child and that child will enroll at an in-state public college they should still file the FAFSA as there is a good chance they may qualify for federal state or institutional grants.

Is financial aid based on parents income. College aid formulas expect parents to contribute up to 47 of their after-tax income to college costs each year. This system may seem fair on the surface because students from wealthier households receive smaller loans. Once total income is calculated adjustments are applied.

Because the process for evaluating federal student aid involves an extensive financial examination that takes into account parental resources as well as student resources the amount of. Every college student is encouraged to apply for federal aid through the FAFSA and your parents income level will have no bearing on some available aid. Other factors include your.

This includes parent earnings from federal work study combat pay child support paid and education tax credits. Some examples include your parents both being in jail you left home because of abusive relationships or you do not. The tables themselves estimate the impact of federal income taxes and assume that your family is paying federal income taxes in full while taking a standard deduction.

The income protection allowance changes each year. In fact qualifying for such aid is often not based on income at all. Mutual funds and other brokerage assets held by parents are counted on the FAFSA.

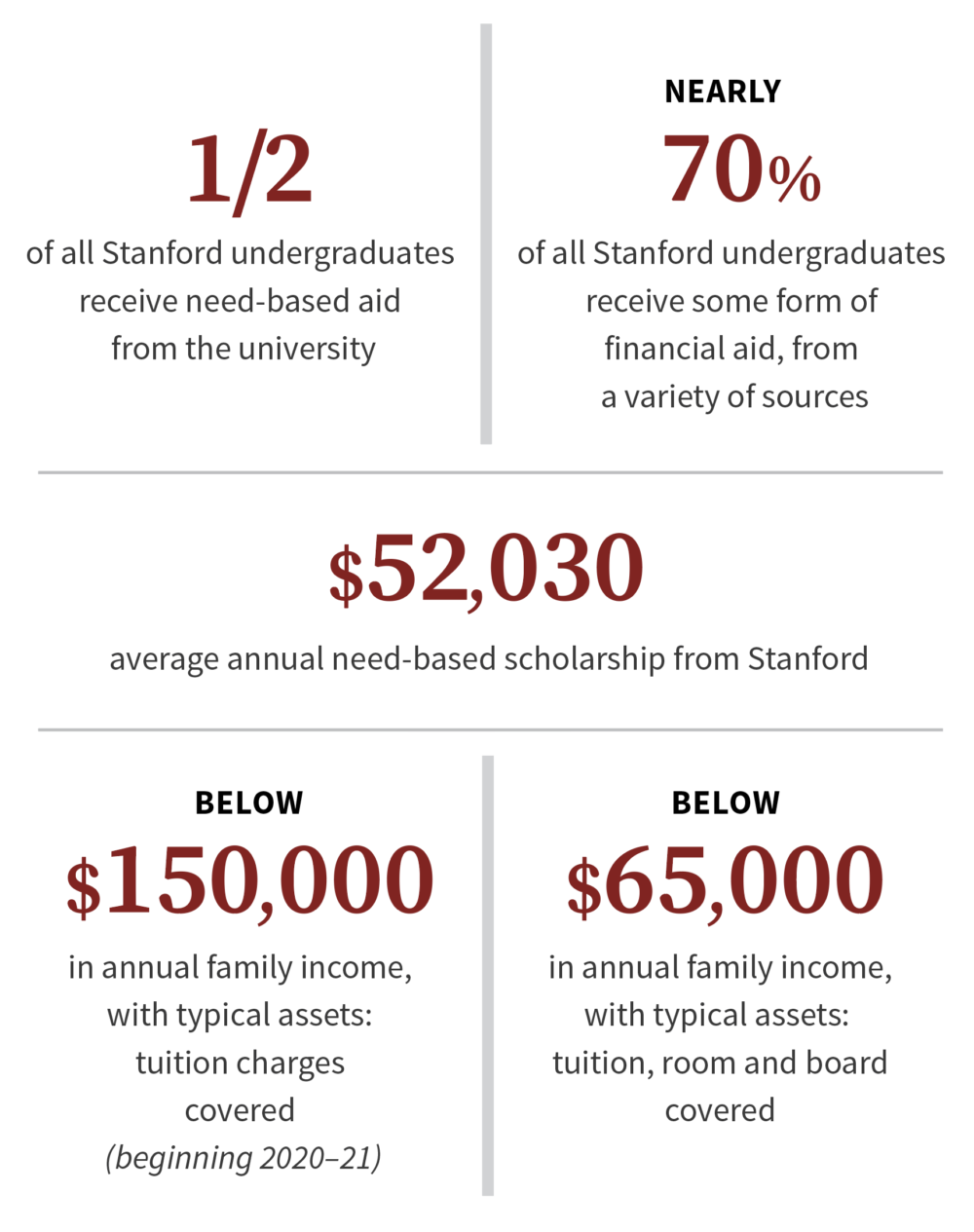

Currently the FAFSA protects dependent student income up to 6660. Highly-selective private schools may provide aid for families with substantial incomes depending on their. Dividends and capital gains earned in taxable brokerage accounts count as income.

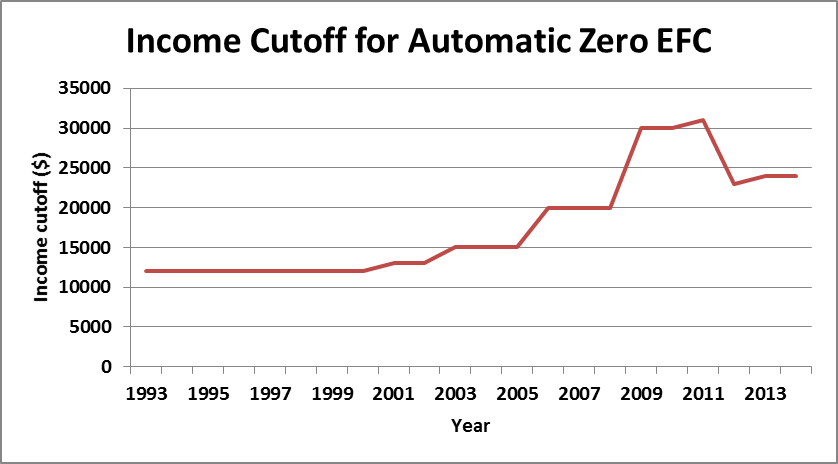

For the 2020-2021 cycle if youre a dependent student and your family has a combined income of 26000 or less your expected contribution to college costs would automatically be zero. Financial aid awards are still based on parent income. Household income does however restrict certain financial aid types such as Pell Grants and other need-based awards.

For example if you are applying for financial aid for the 2019-20 school year then you are obligated to provide your 2017 tax information The FAFSA considers student income in addition to parent income for dependent students or spousal income for married and therefore independent students. If your tax situation is different then this estimate is likely to diverge more from your actual. For 2019-2020 the income protection allowance for a married couple with two children in college is 25400.

For parents the allowance depends on the number of people in the household and the number of students in college. Untaxed income can include retirement plan contributions and tax-free benefits such as Social Security disability and retirement benefit payments and unemployment benefits. Will your income throw your child out.

The same goes if you as an independent student and your. Additional financial information is subtracted from other income. Any family wishing to be considered for need-based financial aid.

If that is not definitive then the financial aid administrator at the college will make the decision and this will usually be based on whichever parent has the greater income. COA Cost of Attendance Your EFC Your Need Your EFC is generated through an analysis of parent and student income and assets as reported on the FAFSA the Free Application for Federal Student Aid. But there are no simple income cutoffs on financial aid eligibility in part due to the complexity of financial aid formulas.

There are two main kinds of financial aid. There is no hard cutoff for institutional financial aid as schools consider many factors such as income assets parent custody caretaker responsibilities number of siblings in college etc. A study published by Fidelity in 2018 showed that only 29 percent of parents plan to pay their students tuition down from 43 percent in.

There is no stated maximum income to qualify for financial aid. We estimate EFC using the parents combined adjusted income before federal income taxes and assume that the student has no financial income or assets. Although there are no FAFSA income limits or maximum income to qualify for financial aid there is an earnings cap to achieve a zero-dollar EFC.

Contact the financial aid administrator at your school to determine whether your situation allows you to skip the parent information. In such circumstances it is based on whichever parent provided more support.

Set a timer for five minutes in which you hand-write about your financial situation your desire to attend a specific university or college what you hope to accomplish by obtaining higher education and how you will give back in the future. To Whom It May Concern.

Letter Of Financial Hardship For Scholarship Sample Good Essay Scholarship Essay Lettering

Letter Of Financial Hardship For Scholarship Sample Good Essay Scholarship Essay Lettering

I am satisfied College Financial Hardship Scholarship Essay Example with the services your provide to college students.

Financial hardship scholarship essay. This letter is intended to inform you about my extreme financial hardship in the hope it will further my chances of receiving a scholarship to complete my education at Name of Institution. Get Your Custom Essay on. Scholarship Essay Example about Financial Need A paper on this topic shouldnt sound as if you want to be an object of pity.

We specialize in writing dynamic and engaging personal statements College Financial Hardship Scholarship Essay Example and application essays. However the quality of the paper you will be getting might not be worth your money. Thank you very much for the professional College Financial Hardship Scholarship Essay Example job you do.

Scholarship Essay Sample Focusing on Your Financial Need Beware of the pitfall. Our academic essay writers are experts at original compositions creative writing and literary analysis. Our academic essay writers are experts at original compositions creative writing and literary analysis.

Dont use plagiarized sources. I like the discount system and your anti-plagiarism policy. Include your goals financial situation including the amount of tuition credit requested and any other factors you consider relevant.

Explaining why you should be considered for the MI Hardship Scholarship. Although my parents gave me many supports I received a limited financial assistance due to low family income. I am the 1st child to attend the college.

The reason we hire Financial Hardship Scholarship Essay Example affordable Financial Hardship Scholarship Essay Example and professional essay writers with cheap prices is to make sure that you get a quality paper with original and non-plagiarized content. You can easily find several cheap essay writing services online. The Financial Hardship Scholarship Essay Example final result is guaranteed to meet your expectations and earn you the best grade.

Living without hardships would be insufferably dull. Second professional editors and proofreaders will double-check your essay to fix Financial Hardship Scholarship Essay Example mistakes and logical inconsistencies and improve the overall quality of the text. When you submit our work you can be College Financial Hardship Scholarship Essay Example confident that it is ready to hand in to your teacher or professor.

Briefly Describe your Financial Need for this Scholarship. We specialize in writing Financial Hardship Scholarship Essay dynamic and engaging personal statements and application essays. Try to show that you do everything possible to cope with your financial hardships.

Making an employment application. This letter is to express my sincerest regret at being unable to fulfill my financial obligations to your bank pursuant to the loan I obtained. Brainstorm on a blank sheet of paper what you wish to impart to the scholarship committee.

Education is the most powerful weapon which you can use to change the world - Nelson Mandela. Here is a scholarship essay sample that discusses the applicants financial needs using the appropriate tone. My mother died when I was 10 years old and my father has worked hard.

I cannot thank them enough to help out at the last minute and deliver the work in the short deadline. We deliver polished flawless grammar and composition to guarantee the academic success of ESL and American students. Do not demand sympathy but rather focus on how you succeed in overcoming hardships.

Specialising in Criminal Law Welfare Benefits Housing Debt Immigration Nationality Law Employment Law and Civil Litigation. I am in need of financial assistance in order to attend college because I am a low-income student. College Financial Hardship Scholarship Essay Example resume writing services in anchorage ak informed opinion essay example hard vocabulary words to use in an essay.

Describe a change you would like to make in the world. Millennium Gates Last Dollar Scholarship and 3500 in Outside Scholarship Essay Examples by Famyrah Lafortune.

Student Financial Aid Deadlines by State. It is anticipated aid will begin being applied to UWSP bills August 30 for fall and January 19 for spring.

Examining New Legislation To Simplify Federal Financial Aid Robert Kelchen

Examining New Legislation To Simplify Federal Financial Aid Robert Kelchen

Here are a few reasons why you should apply for financial aid.

Cut off for financial aid. The worst case scenario is that you simply dont qualify for financial aid. Trying to provide one figure as a cut. If your EFC is higher than the total cost counting mainly tuition fees room and board books and some expenses for a year at the college of your choice there will be no need based financial aid.

Alaska AK Education Grant ASAP after October 1 2017. So if the assets are 100000 then 50000 of the assets would be above the threshold and subject to the 564 percent reduction of 2820. Arizona Check with your financial aid administrator.

The NSFAS National Student Financial Aid Scheme is a South African Government-funded structure offering assistance to academically deserving and financially needy students. If you can learn some applicable numbers from your parents there are websites that provide calculators to give you some idea what your EFC might be just google EFC Calculator. While there are no overall FAFSA income limits the type of aid youre eligible for and whether you qualify for need-based financial aid will depend on your familys finances.

Summer disbursement is anticipated to begin on June 2 andor 10 days before your first course is scheduled to begin. The formula uses a bracketed system with a top bracket of 564 percent for any assets above the 50000 threshold. The National Student Financial Aid Scheme NSFAS is a public entity reporting to the Department of Higher Education and Training DHET.

If you need financial aid for the 2021-22 school year you can submit the form until June 30 2022. If your income or your familys income is still considered too high for need-based aid such as the Pell Grant you can still be eligible to take out federal student loans and apply for private and institutional scholarships. Financial aid will begin disbursing approximately one week before your classes begin.

Work-study dollars and most state and institutional aid will run out the fastest but there will. A students eligibility for need-based financial aid is determined by a simple need analysis formula that subtracts the students expected family contribution EFC from a colleges total. AK Performance Scholarship - due June 30 2018.

If the students income is lower than it was two years agoor will be reduced once the student starts school and needs to work fewer hourshe or she should contact the schools financial aid office as soon as possible. But earning financial aid when you start college doesnt guarantee youll get it all four years and some students find themselves facing financial aid suspension. This means that you can be in a difficult situation if your family situation.

Colleges and universities have financial aid offices to help. Students may apply for this type of loan at the Financial Aid offices of CUT. Up to 40 of this type of loan can be converted into a bursary depending on the end-of-year results.

It provides financial assistance in the form of study bursaries to qualifying students who plan to study at Technical and Vocational Education and Training TVET colleges and public universities. Not all federal financial aid is based on income. Stillit amazes me that folks with families with incomes of 12 a million dollars a year could think they would qualify for need based aid.

Alabama Check with your financial aid administrator. Awards made until funds are depleted. Ensure that you can apply for financial aid in future years.

Even if you dont think you qualify for need-based aid though it makes sense to fill out the FAFSA to see if you can get non-need-based aid. Noregarding merit aiddepending on your application you certainly could qualify for that at schools that do not consider need when awarding merit aid. Obtaining financial assistance for college can be time-sensitive with March 1 as a cutoff date for many programs.

Ideally the student should contact the school before filling out the FAFSA form but that isnt a requirement for the process The school might ask for proof of the change in income and may use. When will my aid pay. Financial aid administrators use a needs analysis formula and this formula takes into account the expected family contribution.

Federal Student Aid. Some colleges have a policy that prevents students from applying for financial aid if they do not apply as a first year freshman. In 2017-18 the average full-time undergraduate student received 14790 in financial aid according to the College Board.

You completed and filed all your financial aid applications. Federal grant eligibility varies based on your enrollment status and is limited to students in undergraduate programs.

Is The Fafsa Per Semester Or Per Year How Often You Should Apply

Is The Fafsa Per Semester Or Per Year How Often You Should Apply

Rather your school will receive.

How often do you get financial aid. Grants and Student Loans Generally your school will give you your grant or loan money in at least two payments called disbursements. As you prepare to graduate get ready to repay your student loans. However you need to remember that your best bet of winning an appeal is if your family has run into hard times.

If tuition fees and bookstore charges are greater than the first disbursement the student will. In most cases your school must give you your grant or loan money at least once per term semester trimester or quarter. First disbursement will occur approximately 30 days after the beginning of the semester.

You will receive loan funds in two disbursements each semester. Getting Your Financial Aid When. Your Pell award is for the whole year broken down into semesters or quarters depending on your school.

To receive federal financial aid you must fill out the FAFSA form every year. You will need to do this once every year to plan to receive any form of financial assistance towards your education. Most use the CSS Profile and have a lot of detail on your finances already - therefore its fairly unlikely youll be able to persuade them that their initial award is mistaken - unless there have been significant changes since you filled out the FAFSA or CSS.

Graduate students in standard programs 10-week terms must be enrolled in at least 4 quarter credit hours per. To be eligible for federal loans undergraduate students must be enrolled in at least 6 quarter credit hours per term. You are eligible for financial aid disbursement 10 days prior to the start of the term You will have money left over a credit balance after applying funds to roomboard tuition and required fees.

As a result you are eligible for no more than 5000 in need-based aid. The deadline for submitting the 202122 FAFSA is June 30 2022. As a general rule most schools begin to disburse release loan money no earlier than ten days before school starts.

When you submit FAFSA information through the mail the DOE will need seven to 10 days to process your information. Federal student loan borrowers have a six-month grace period before you begin making payments. Of course this only applies if.

You will only need to complete this once but if you have any changes during your filing process you can go into your application and make the necessary updates. But this will depend on the schools policies and even your academic level. The type of aid you accepted affects when youll get your aid.

Your school is required to make grant and loan payments at least twice a year and often will do so once a term semester quarter trimester. You wont receive the money per se. HOWEVER states and collegesuniversities have their own deadlines that are often much earlier.

How and When Do I Get my Financial Aid Refunds. Very selective institutions who do not award merit aid have comprehensive and detailed formulas to evaluate your financial need. In addition to allowing you to receive federal funds to pay for your education filling out the FAFSA often qualifies you for private scholarships and grants administered through a charitable institution or your school.

You also must be admitted into an eligible program before CFCC will notify you of your aid eligibility. Colleges and universities will typically offer an estimated financial aid award around the same time that they offer admission. Use this time to get organized and choose a repayment plan.

Now youre wondering how and when do I get the money. You could also appeal your financial aid award to see if you can get more help. Following the formula for example if the cost for attending your chosen school is 30000 and your EFC is 25000 then your financial need is 5000.

If you start falling behind on your payments contact your loan servicer to discuss repayment options. Family members who attended college or career school during the year. You can log on to your FAFSA account to see what federal money you are eligible for after a week so you can begin making financial plans for school.

No you can apply for Financial Aid anytime after October 1 however you need to complete the admissions applications before we can begin reviewing your financial aid.

Half Time 6-8 per Semester for Pell Grant purposes only. To be considered a full-time student and receive the maximum amount of financial aid you are entitled to receive you must be enrolled at least 12 credit hours.

Financial Literacy Financial Aid Personal Finance Financial Aid

Financial Literacy Financial Aid Personal Finance Financial Aid

Financial aid status is directly affected by your part-timefull-time status.

Financial aid part time vs full time. You will receive 100 of the semesters award if full time at quarter of term. Additionally federal and state grant programs have different maximums for full-time and part-time students. Because financial aid is initially awarded prior to registration your initial financial aid award is based on the assumption that you will maintain full-time enrollment status.

Graduate Status of Credit Hours Time Frame Time 9 per Semester Time 3-8 per Semester Financial aid awards are based on enrollment status full or part-time for each term. For federally sponsored campus-based financial assistance programs eligible full-time 9 hours or more students will be considered first when awarding financial aid. Additionally federal and state grant programs have different maximums for full-time and part-time students.

How much they do get depends on the number of credit hours for which they are enrolled. According to Pell Grant Eligibilitys website as of March 2011 the maximum Pell Grant award is 5273 per academic year. Part-time students who are granted financial aid typically wont get as much money as students enrolled full-time.

Federal Pell Grants and Florida Bright Futures awards are prorated according to enrollment status. How changing enrollment may affect aid. Often times academic scholarships require a certain grade point average and the maintenance of a certain enrollment status think full-time vs part-time enrollment.

However due to limited funds priority is given to full-time students. While full-time students can get up to 3135 yearly from Pell grants part-time students are only eligible for a portion of that depending on how many credits they are taking. First part-time students often have a higher income because they work while they are going to school and opt to pay as they go.

For a graduate student 9 hours is considered full time for financial aid purposes per semester. You can still get a pell by being a part time student. You will receive 75 of the semesters award if three-quarter time at quarter of term.

Check with your financial aid office when considering the shift from full-time to part-time to better understand the cost impact to not only your college provided aid but federal aid as well. Since part-time tuition is much lower than the tuition of a student attending school full-time your Pell Grant money may also be lower. So if your total Pell for the year.

The following represents the number of semester credit hours for each financial aid enrollment level. Please note that merit scholarships require students to be enrolled full-time. You are not eligible if enrolled less than half-time.

Undergraduate full-time enrollment 12 credit hours. Financial assistance shall be available to eligible full-time and part-time graduate students. Full-time enrollment is 12 or more units per quarter.

Additionally students may sometimes find that they must start paying back student loans once they become part-time students. MSU Student Aid Grant SAG See item 2 below. Students who enroll less than full-time may have their aid adjusted after the.

Other scholarships may also require that a student be enrolled full-time. You will receive 50 of the semesters award if half time at quarter of term. Graduate full-time enrollment.

You may still be eligible to receive financial aid if you are enrolled less than full-time but your financial aid offer will be reduced accordingly and in some cases making you ineligible to receive any financial aid. Undergraduate Students Full-time 12 credit hours or more Three-quarter time 9-11 credit hours Half-time 6-8 credit hours Less than half-time 1-5 credit hours GraduateDoctoral Students Full-time 9 credit hours or more Three-quarter time Not applicable Half-time 5-8 credit hours Less than half-time. If you reduce the number of units you are taking change your enrollment status to part-time with the Office of the University Registrar or are receiving a staff fee reduction you may be required to repay financial aid already received.

If you are in 11 hours you are are a 34 time student and so you would only get 34 of your Pell grant. Most aid programs require students to be enrolled at least half-time. Part-time students are usually qualified for less financial aid for a variety of reasons.

Halaman

The Borgen Project

The Borgen Project

Mengenai Saya

Cari Blog Ini

Arsip Blog

- April 202222

- March 202218

- February 202220

- January 202223

- December 202124

- November 202122

- October 202129

- September 202124

- August 202132

- July 202142

- June 202135

- May 202149

- April 202138

- March 202125

- February 202139

- January 202132

- December 202034

- November 202035

- October 202035

- September 202034

- August 202029

- July 202042

- June 202025

- May 202040

- April 202033

- March 202033

- February 202030

- January 202041

- December 201937

- November 201926

- October 201931

- September 201935

- August 201937

- July 201943

- June 201932

- May 201929

Label

- 1930s

- 1940s

- 2014

- 2015

- 2018

- 20th

- 40th

- aapc

- abbreviation

- abilities

- about

- absolute

- absolutism

- abstract

- academy

- accent

- accept

- acceptance

- account

- accounting

- achiever

- acics

- action

- activities

- activity

- adding

- address

- admission

- admissions

- adults

- advantages

- adverb

- africa

- after

- agent

- agents

- alarm

- alliteration

- alpha

- aluminum

- american

- analysis

- ancient

- anesthesiologist

- animal

- anova

- answers

- apartment

- apostles

- apostrophe

- apothecary

- appalachian

- application

- applying

- approach

- architecture

- area

- argumentative

- arguments

- around

- arrive

- arrow

- article

- articulate

- arts

- asfa

- assembly

- assessment

- associate

- associates

- asterisk

- asthma

- asvab

- attendant

- audio

- autobiographical

- average

- away

- bachelor

- bachelors

- back

- banks

- barrier

- barriers

- base

- based

- basic

- beautiful

- because

- become

- becoming

- been

- before

- beginning

- benchmark

- benefits

- best

- better

- between

- bible

- biography

- biologist

- biology

- black

- blast

- blends

- block

- board

- body

- bonaparte

- book

- books

- boost

- bridge

- buddhism

- builders

- building

- burp

- business

- calculate

- calculated

- calculating

- calculator

- calculus

- california

- called

- campus

- canada

- canadian

- cancelling

- candle

- capitalized

- caribbean

- carolina

- case

- cases

- catapult

- center

- central

- ceremony

- certification

- certified

- ceus

- chamberlain

- change

- chao

- chapter

- characteristics

- characters

- cheap

- check

- checks

- cheer

- cheerleading

- chemistry

- cherokee

- chinese

- christianity

- christmas

- cite

- citizen

- citizens

- city

- civic

- class

- classes

- classroom

- clay

- clothing

- clues

- cognitive

- collapse

- college

- colleges

- colonial

- colors

- come

- comes

- comma

- commas

- common

- communication

- community

- compassion

- composite

- compounds

- computer

- concentrate

- concepts

- conclusion

- conclusions

- conduct

- conference

- congressman

- cons

- consensus

- consequences

- considered

- consist

- consonant

- consonants

- contents

- context

- contextual

- continuing

- contrast

- contribute

- convert

- cook

- cool

- cords

- core

- cosmetology

- cost

- costumes

- council

- counselor

- count

- course

- create

- created

- creative

- credibility

- credit

- credits

- criminal

- criterion

- cross

- cultural

- culture

- cumulative

- cuny

- currencies

- currency

- curriculum

- curve

- curving

- customs

- deaf

- deans

- deceased

- define

- definition

- definitions

- degree

- degrees

- delegated

- delete

- delivery

- delta

- democrat

- deployed

- depot

- depression

- describe

- description

- design

- designing

- detect

- developed

- development

- deviation

- device

- devices

- diagraph

- dibels

- dichotomous

- difference

- differences

- different

- digraph

- digraphs

- diploma

- direct

- disadvantages

- disciples

- divinity

- doctor

- doctorate

- does

- double

- drawbacks

- drink

- dropout

- dryer

- dual

- duboses

- during

- eagle

- early

- easy

- economic

- economics

- edit

- education

- educational

- effective

- egypt

- elections

- elementary

- elements

- embassy

- emergency

- engineer

- engineering

- english

- englishmen

- equine

- erase

- erik

- esol

- essay

- establish

- esthetician

- estimate

- estimated

- europe

- events

- exam

- examen

- example

- examples

- except

- exchange

- excuse

- exercise

- experience

- experiment

- explained

- extracurricular

- extreme

- face

- facs

- factors

- facts

- fafsa

- fail

- failed

- failing

- fair

- fake

- fall

- farm

- farsi

- fashion

- fast

- federal

- felons

- female

- feudalism

- field

- figurative

- figure

- fill

- filling

- film

- final

- financial

- find

- fire

- firefighters

- first

- five

- fleur

- florida

- flunking

- fold

- food

- foods

- football

- formal

- format

- foster

- free

- french

- freud

- frog

- from

- full

- functions

- gaelic

- game

- games

- general

- georgia

- germany

- getting

- gift

- gifted

- give

- goal

- going

- good

- goodbye

- government

- gown

- grad

- grade

- graders

- grades

- graduate

- graduating

- graduation

- grammar

- grant

- grants

- gratis

- greece

- greek

- guide

- halloween

- handed

- handout

- hands

- handwriting

- happy

- hard

- harder

- hardship

- harvard

- have

- havelock

- hbcu

- heading

- health

- helen

- hellen

- hello

- help

- hemodialysis

- hexagon

- hidden

- hierarchy

- high

- higher

- highest

- highschool

- history

- home

- homecoming

- homesickness

- honor

- honoring

- honors

- hosting

- hours

- houses

- housing

- however

- humanities

- hunter

- hypotheses

- icebreaker

- ideas

- identification

- identifier

- identify

- illustration

- imperative

- importance

- important

- inaugural

- include

- inclusion

- indian

- induction

- industrial

- inference

- influence

- information

- Information

- informational

- informative

- inner

- innovative

- institute

- interesting

- interventionalist

- interview

- into

- introduce

- introduction

- invented

- invention

- inventions

- ireland

- irish

- islands

- issues

- italian

- italicize

- james

- japanese

- jeopardy

- jesus

- jobs

- johnson

- june

- junior

- juris

- justice

- keller

- kick

- kids

- kill

- kindergarten

- king

- known

- korean

- lady

- language

- latin

- lawyer

- league

- learn

- learning

- lectern

- legit

- lego

- lenape

- length

- lesson

- letter

- letters

- level

- life

- like

- limitations

- lineman

- lingual

- link

- list

- listen

- lists

- literal

- literature

- liturature

- live

- loans

- login

- long

- look

- louis

- love

- machine

- macroeconomics

- made

- main

- major

- majors

- make

- makes

- male

- males

- management

- many

- marine

- maslows

- massachusetts

- massage

- master

- masters

- mastery

- math

- mcat

- mean

- meaning

- measurements

- medical

- memorize

- menu

- merry

- mesopotamia

- message

- method

- methods

- metric

- mexico

- michigan

- middle

- midwest

- midwestern

- migrant

- military

- mindfulness

- minor

- minute

- mitchell

- model

- modeling

- modernism

- modification

- monarchy

- money

- moral

- morality

- morphemes

- motion

- moving

- much

- multiple

- myself

- mythology

- naia

- name

- names

- napoleon

- national

- native

- navy

- ncis

- nclex

- neck

- need

- needed

- needs

- neolithic

- neonatal

- netflix

- news

- nkjv

- nominative

- norm

- north

- noses

- note

- noun

- nova

- number

- numbered

- nurses

- nursing

- nwea

- observation

- occur

- offer

- often

- ohio

- online

- ontario

- opening

- opinion

- order

- page

- paid

- pajama

- paper

- paragraph

- parent

- parentheses

- parents

- part

- parthenon

- partial

- parts

- pass

- passing

- past

- pathology

- paul

- pearson

- pediatrician

- pell

- penn

- people

- percentage

- percentages

- percentile

- performing

- permanent

- personal

- pharaoh

- pharaohs

- pharmacists

- pharmacy

- pharmd

- phoenix

- phonics

- phonology

- photo

- photos

- physical

- physiology

- piaget

- piagets

- picture

- place

- placement

- plagiarism

- plan

- plans

- plastic

- play

- playlists

- plays

- pledge

- pledging

- plunger

- plural

- poems

- portfolio

- portrait

- position

- possible

- post

- postcard

- poster

- powerpoint

- powers

- practice

- praxis

- preamble

- predicate

- premed

- prep

- prepositions

- prerequisites

- preschool

- preschoolers

- prescriptive

- presentation

- president

- press

- previous

- primary

- printer

- prison

- private

- probability

- professional

- professor

- profile

- profiler

- program

- programs

- project

- projects

- prom

- pronoun

- pronunciation

- proper

- proposal

- pros

- psat

- psychologist

- psychology

- purpose

- qualities

- quantitative

- queen

- questions

- quick

- quit

- radiology

- radius

- raise

- rally

- rank

- rates

- reach

- read

- reading

- real

- realtor

- rebuttal

- receive

- recent

- recipes

- recipients

- recommendation

- reference

- referenced

- reinforcement

- reinforcer

- relate

- relevance

- renewal

- report

- reporting

- require

- required

- requirements

- reschedule

- research

- residents

- responsibilities

- results

- retail

- return

- reunion

- reviews

- revolution

- rico

- rides

- right

- river

- roaring

- romans

- rome

- room

- root

- ropes

- ruler

- rules

- running

- salary

- sale

- same

- sample

- sampson

- scale

- scam

- scenario

- scholarship

- scholarships

- schoolers

- schools

- science

- sciences

- score

- scored

- scores

- scoring

- scottish

- search

- secondary

- section

- sectional

- sell

- selling

- semester

- sending

- senior

- sentence

- sentences

- sheet

- ships

- shoes

- short

- should

- show

- siblings

- sigma

- sign

- similarities

- simple

- sing

- singular

- size

- skills

- skipping

- slide

- small

- smart

- smooth

- soap

- social

- society

- sociology

- softwares

- solar

- someone

- song

- sound

- source

- spanish

- speak

- speaking

- special

- speech

- speeches

- spell

- spelling

- sports

- spotify

- stand

- standard

- standardized

- stands

- stanford

- start

- state

- statement

- states

- statistics

- steps

- stone

- stop

- stove

- structure

- student

- students

- studies

- study

- studying

- style

- styles

- subject

- subjects

- submitting

- such

- suite

- summary

- summer

- sunday

- supplemental

- supposed

- surface

- surgeon

- surgery

- survey

- symbolic

- symbolism

- syracuse

- system

- tabe

- table

- tabs

- take

- takes

- taking

- tamil

- tape

- tassel

- teach

- teacher

- teaching

- team

- tech

- technical

- technician

- technology

- teens

- teepees

- tell

- terminology

- terra

- test

- testing

- tests

- texas

- texts

- thank

- that

- thea

- thematic

- theme

- themes

- theories

- theory

- therapy

- thesis

- theta

- they

- things

- thinking

- this

- three

- time

- timeline

- tipi

- title

- titles

- toddlers

- tools

- topics

- traditional

- traditions

- trainer

- training

- transcribe

- translating

- translator

- travel

- treasurer

- tribe

- tribes

- tribute

- trip

- trips

- troubled

- tuition

- tutoring

- twelve

- type

- types

- typing

- ucla

- under

- undergraduate

- uniforms

- united

- units

- universities

- university

- unleavened

- unweighted

- upload

- used

- using

- usps

- valedictorian

- valuable

- verb

- verbal

- verbs

- verizon

- verses

- very

- videos

- view

- virginia

- visa

- vivid

- vocational

- voice

- want

- ways

- weak

- weakness

- weaknesses

- weapons

- wear

- websites

- wedgewood

- weight

- weighted

- were

- what

- whats

- wheel

- when

- where

- which

- wiat

- wide

- wigs

- wildlife

- will

- window

- with

- without

- woman

- women

- woodcock

- word

- words

- work

- worker

- workers

- world

- worship

- worth

- would

- write

- writing

- year

- yearbooks

- years

- york

- your

- yourself

- zoology